With $600M raised and $100M+ in ARR, Airtable is betting that it can be around for the long haul and capture the massive whitespace that is no/low-code for the enterprise-once the market catches up. Eventually, they started using language that shows that Airtable is more than just a productivity tool, sometimes kind of emotive language around the fact that it’s empowering and they’ve created these things that are really applications as opposed to just ‘using’, and so overall there is this qualitative shift that even if they don’t fully understand the distinction of what is an application versus a database versus a spreadsheet, they do start to feel this sense of ‘I’m creating something that’s more than the sum of its parts. “Eventually, they started using language that shows that Airtable is more than just a productivity tool, sometimes kind of emotive language around the fact that it’s empowering and they’ve created these things that are really applications as opposed to just ‘using’, and so overall there is this qualitative shift that even if they don’t fully understand the distinction of what is an application versus a database versus a spreadsheet, they do start to feel this sense of ‘I’m creating something that’s more than the sum of its parts,” Liu said.

#SELL AIRTABLE TEMPLATES SOFTWARE#

Airtable has a similar opportunity in B2B SaaS, to build software for the whitespace between sales, marketing, recruiting, and so on.

Peter Fenton from Benchmark said Airtable had the best retention numbers he’d ever seen. Teams that replaced Airtable with an off-the-shelf tool didn’t churn, because other use cases emerged.

Since 2018, Airtable has fully shifted from a consumer/prosumer focus to B2B.Their key levers for growth are increasing seats within an organization and increasing their price per seat (ARPU).

#SELL AIRTABLE TEMPLATES PRO#

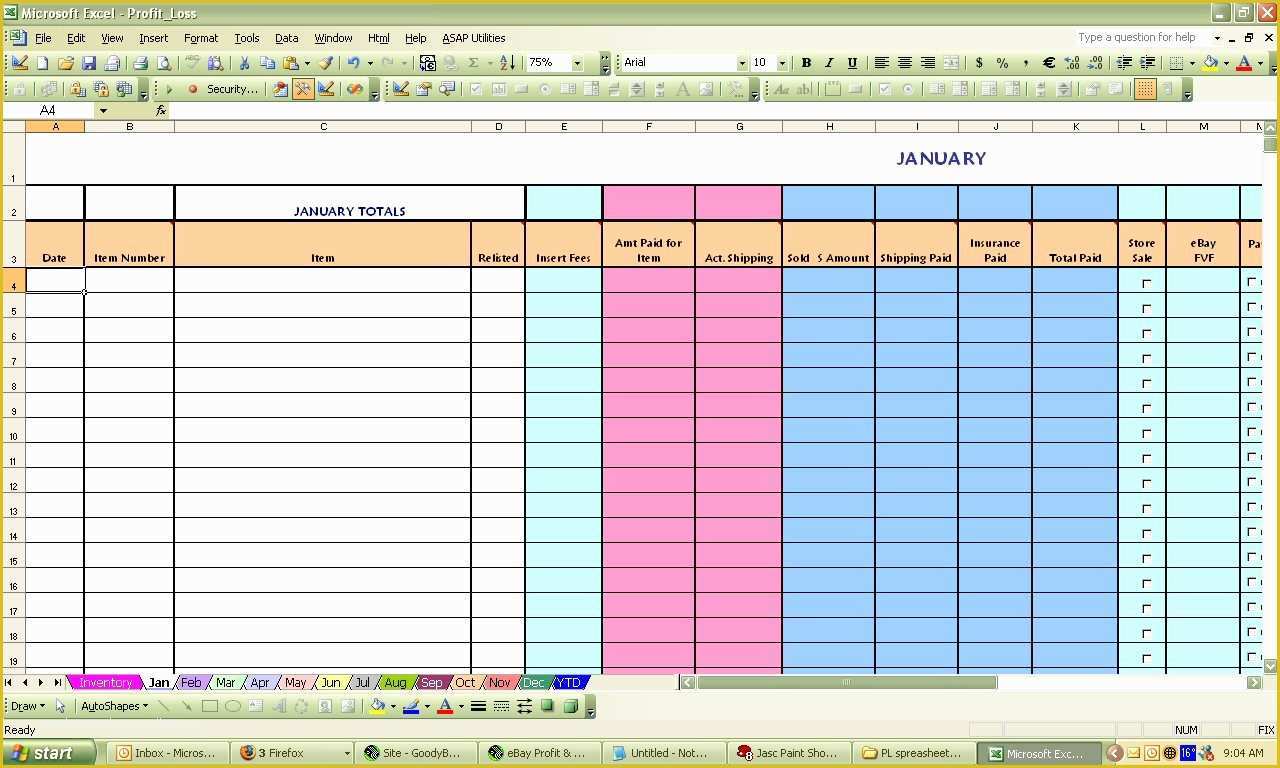

Airtable has pro plans for businesses as well as an enterprise plan that includes hands-on services-based consulting work to help optimize team usage of the product.Its core abstractions-tables, records, views, apps and automations-give it the functionality of a basic CRUD app. Airtable is a collaborative SaaS platform with a spreadsheet-like interface for building relational databases without code.That's comparable to Twilio and Carta, which also took about 3.5 years to get from $10M to $100M ARR. A cross our index of SaaS companies, Airtable was the slowest to get from $0 to $10M ARR, and one of the fastest to get from $10M to $100M.That’s based on the 67x 2021 ARR multiple at which they were valued in their last round in March 2021 round ($5.77B valuation at $85M in ARR). We estimate Airtable’s ARR at $115M for a valuation of about $7.7B.That combination aligns with Airtable’s ultimate vision: marrying a consumer-grade app with the potential to go upmarket and build the next big enterprise product. That new C-suite brings insight and experience from companies like Atlassian, InVision, Wrike, LogMeIn, WndrCo, Quibi, Uber and Instagram-a mix of rapidly high-growth startups, upmarket SaaS products and consumer apps.

0 kommentar(er)

0 kommentar(er)